Deliver Personalized Services and Increase Profits with Softnet’s Loan & Credit Union Software

Store Loan details efficiently, reduce costs, provide better services for your members and accurate reporting for your management team using Softnet’s Loan & Credit Union Software. Combine all the key data from registries in one central system, classify member records, and loan & account details, for better management and accounting.

Our software simplifies credit union accounting, by providing time-saving automation features that are designed specifically for the industry. It handles large volumes of loan applications, products, and services very efficiently. From loan management, to servicing, and risk analytics, the suite drastically improves the lending experience for your borrowers. It also streamlines workflows and helps your employees focus better on customer relationships.

Features

We have loaded our suite with a range of features. It can help you,

- Close everyday accounts, and maintain average balances.

- Automate workflows within your offices.

- Reconcile with banks for smooth transactions.

- Generate Detailed reports for audits, and accounts.

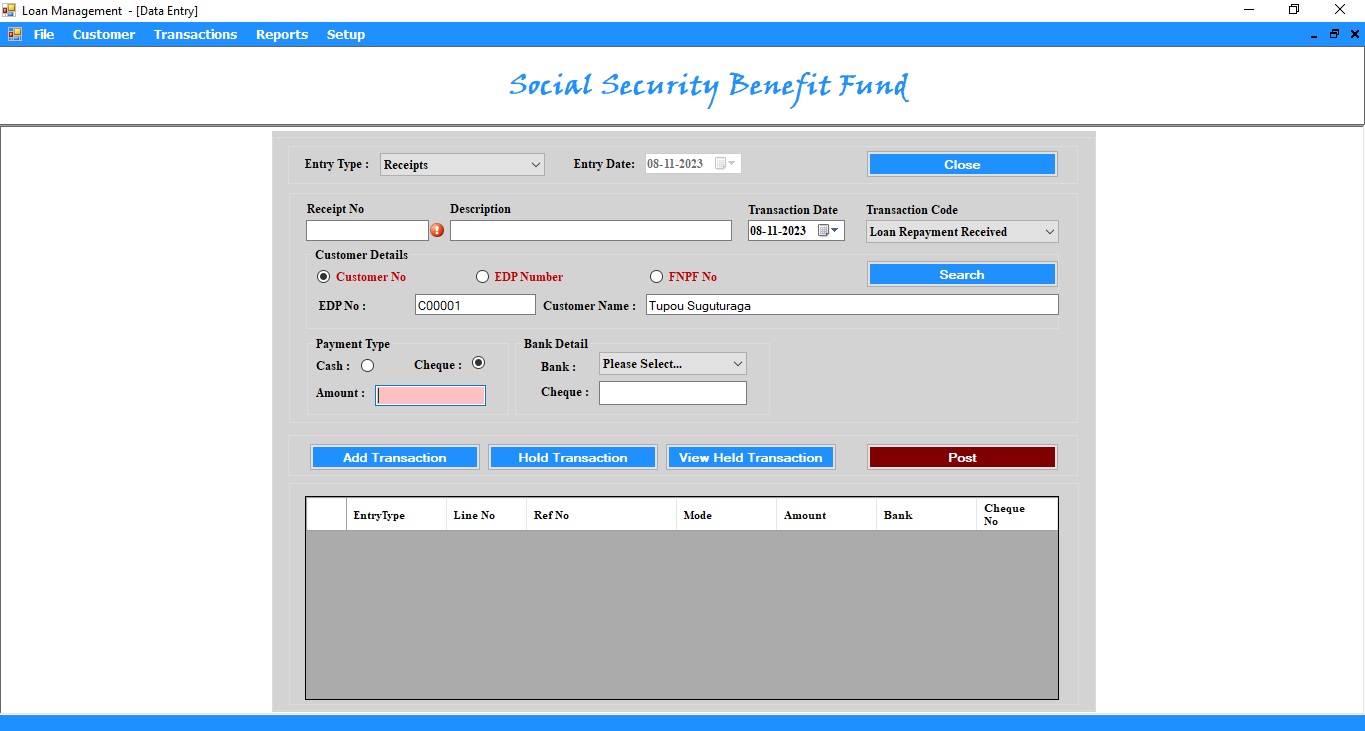

- Manage multiple entries and data sets.

- Generate customizable loan forms and applications for your customers.

- Integrate with bank apps for easy information sharing.

- Provide accurate post-loan monitoring.

- Assess credit using CIBIL/Credit Scores.

- Generate up-to-date loan applications and documents.

- Collect and sequester interest and debt payments.

- Automate repetitive functions and improve efficiency in your offices.

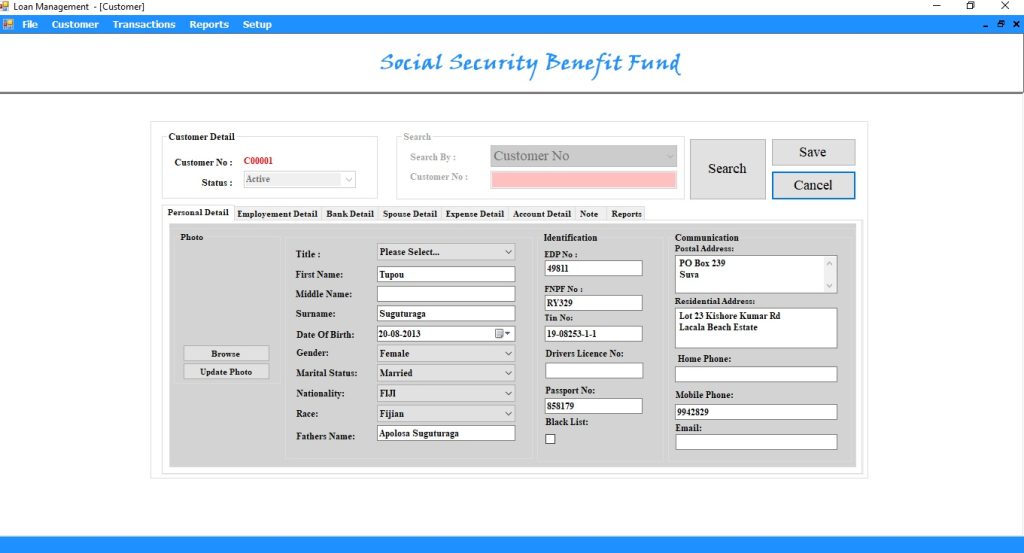

Softnet’s Loan and Credit Union Software brings together all your key data into one central system and improves overall efficiency in your organization. We have also included Know Your Customer (KYC) information to identify and verify the business/company’s registration details, directors and management details, ownership structure, authorized signatures, and recent bank statements of the applying parties.

It determines the creditworthiness of the applicants based on their bank statements or transaction data. The revenue and expenses from transactional history is analyzed by the software, and it generates a cash flow analysis for the loan applicants, which is used to assess their credit risk.

With this streamline operation on your servers, you will gain more time to focus on customer service, growing portfolios, and cross-selling your other products.

Advantages

Softnet’s Loan and Credit Union Suite offers you the following advantages over other similar software in the market.

- It helps you reduce errors and improves data integrity and accuracy.

- Comes with Enhanced security. It is SOC 2 Compliant, password protected, and comes with multiple encryptions.

- It makes it easy to search records and store documents efficiently. You no longer have to sift through files and excel sheets regarding customer data.

- It provides comprehensive management information and generates detailed reports regarding loans and debts.

- The software platform is very flexible and can be fully customized to your needs.

- It can integrate with other software systems easily.

- We provide 24/7 back-end support to your team, for smooth operation of the software.

- We also provide regular updates for the software, and for tax rates, statute updates, etc.

FAQ

Benefits

Softnet’s Loan & Credit Union Software is easily Customizable and comes with many add on modules too. The system can be customized to specifically to suit your business requirements. It provides room for scalability as well. Therefore, it can be installed in your central servers and implemented across all your branches. We will explain its advanced functionalities during the live demo. Call us and book a slot with our executives.

The suite comes in handy for automatic production and storage of documentation related to loans, credits, debts, and revenue. It gives you immediate access to a complete audit history for all projects undertaken by your firm. Flexible workflows can be created using the software and tasks assigned to employees with automatic prompts, reminders and checklists. This drives up efficiency in your offices. We will be at your offices with the software with just a phone call. Send us your details and our executives will get back to you ASAP for the Live Demo.